The Upcoming P11D Changes: What They Mean for Your Business and Your Employees

The way employee benefits are taxed is about to change — and it’s one of the biggest shifts in years. The government has confirmed that the traditional P11D process will gradually be phased out, with most benefits in kind moving to real-time payrolling.

While the full details are expected to be confirmed in the Autumn Statement, we already know enough to understand what’s coming — and how it could affect both businesses and employees.

This blog breaks down what’s changing, what it means for you, and what you can do now to get ahead of the curve.

Why the P11D is Changing

For years, the P11D has been used to report benefits such as company cars, private medical insurance, or vouchers given to employees — anything that isn’t part of their salary but still has a taxable value.

Under the new approach, these benefits will be reported and taxed via payroll in real time rather than retrospectively at the end of the tax year. In other words, tax will be deducted from employees’ pay as the benefit is provided, rather than through the P11D process months later.

This change is part of HMRC’s wider push towards modernisation and simplification — reducing paperwork and giving employees a clearer view of their tax position throughout the year.

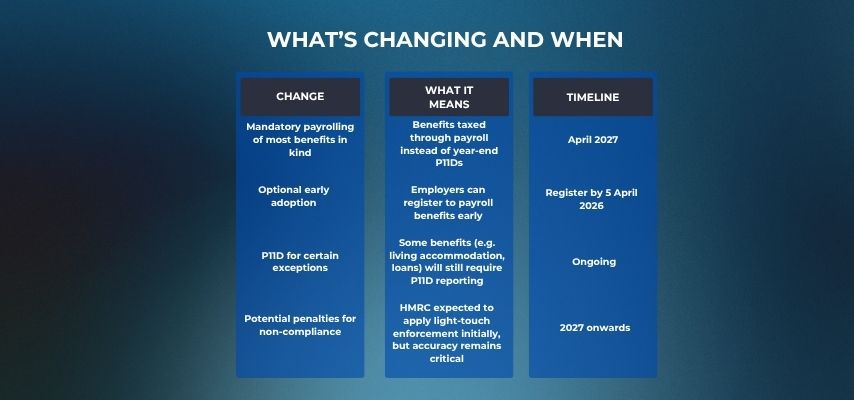

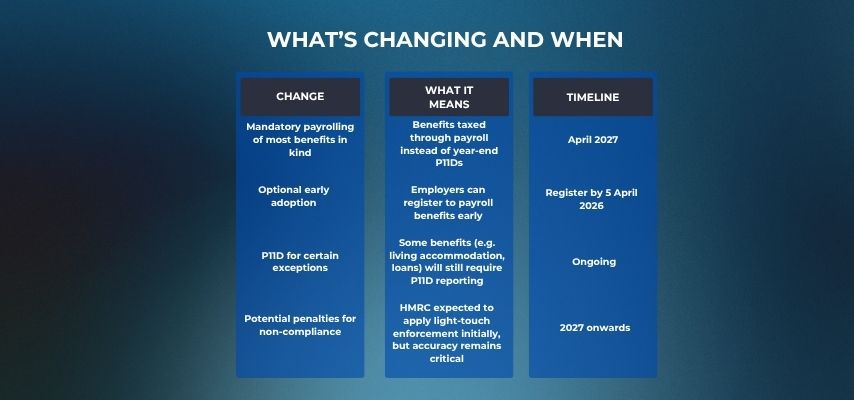

What’s Changing — and When

The government plans to make payrolling benefits mandatory from April 2027. Between now and then, employers can choose to opt in early by registering with HMRC before 5 April 2026 to begin payrolling benefits voluntarily for the 2026/27 tax year.

1. Greater Payroll Complexity

Under the new rules, payroll teams will need to calculate and include taxable benefit values in real time. That means:

Payroll systems will need to be updated or replaced to handle the extra data.

HR, finance, and payroll will have to work more closely together to ensure all benefits are correctly valued and recorded.

Errors could affect both employee pay and employer compliance, so processes will need tightening.

2. More Frequent Cash Flow Impacts

With benefits taxed each pay period, tax and National Insurance liabilities will be spread across the year. While this gives more predictability, it also means employers will see a steady flow of benefit-related costs rather than a single year-end adjustment.

3. Employee Communication Becomes Essential

Employees will start noticing tax deductions linked to their benefits appearing directly in their payslips. For many, that could be confusing or frustrating if not clearly explained.

Employers will need to help their teams understand:

How benefits are valued

Why the timing of tax deductions is changing

How it affects their take-home pay

4. Rethinking Benefit Packages

Some companies may decide to simplify or restructure their benefits packages to make administration easier.

Perks that are complex to value or low in perceived value may be dropped, while other benefits — like cash allowances — could become more attractive alternatives.

5. Increased Risk During the Transition

As with any major change, there will be risks of double-counting, missed entries, or payroll errors.

HMRC is expected to take a “soft landing” approach in the first year, but businesses will still need robust controls and accurate data to avoid compliance headaches.

The Impact on Employees

For employees, the biggest change is timing.

Instead of their benefits being taxed after the year ends, tax will be deducted as they receive the benefit — so their take-home pay may be slightly lower each month.

What employees might notice:

Earlier deductions: Taxes on benefits will appear in payslips throughout the year.

More transparency: They’ll see the value of their benefits and associated tax much sooner.

Possible confusion: If communication is unclear, some may think they’re “losing pay” when in fact they’re simply being taxed in real time.

Potential overlap: During the transition, there’s a small risk of double taxation if old and new systems overlap — something HMRC is expected to address before rollout.

Overall, this change should eventually make tax more transparent for employees, but only if employers prepare and communicate clearly.

What to Watch for in the Autumn Statement

The Autumn Statement is likely to:

Confirm the April 2027 implementation date

Provide details on which benefits will be payrolled and which will stay on P11D

Clarify how mid-year adjustments and corrections will be handled

Outline any penalty or grace period for employers during the transition

Set out support for smaller businesses adapting to the new system

How Businesses Can Prepare Now

While we wait for full details, there’s plenty employers can do to prepare:

1. Review Your Current Benefits

Make a list of every benefit you offer — from company cars and healthcare to smaller perks. Work out how each is currently reported and how complex it will be to value monthly.

2. Check Your Payroll System

Not all payroll software is ready for payrolling benefits. Speak to your provider now to make sure you’ll be able to handle real-time reporting and integrate with HR or benefits platforms.

3. Train and Align Your Teams

HR, payroll and finance teams will all be affected. Ensure everyone understands the upcoming changes and who’s responsible for what.

4. Communicate with Employees

Start managing expectations early. Use clear examples and explain how this change may affect pay timing — not overall tax owed.

5. Consider Early Adoption

If your systems and processes are ready, registering for voluntary payrolling ahead of April 2026 could give you valuable time to test and refine before it becomes mandatory.

In Summary

The end of the P11D era marks a major shift in how benefits are taxed. For many businesses, this will mean new payroll processes, tighter integration between departments, and more regular tax reporting.

Handled well, it’s also an opportunity to modernise systems, improve transparency, and strengthen employee trust.

The key takeaway?

Don’t wait until the legislation is confirmed. Start reviewing your benefits, systems, and communication plans now — so when April 2027 arrives, you’re ready to hit the ground running.